The Zurich headquarters has just released the new global brand manual, 140 pages of high-concept positioning, “brand-first” philosophy, and rigid identity guidelines. In the Tokyo office, the local Managing Director flips to page 4, looks at the new “minimalist retail display” requirement, and then looks at the spreadsheet of his top twenty regional distributors.

He knows the new display dimensions will not fit the standardized shelf units used by the drugstores that drive 60% of his revenue. He knows the “bold, identity-driven” copy style violates the informational density requirements of the professional dental channel. He does not argue. He does not push back. He simply signals to his team that they will “study the implementation” while continuing to use the legacy planning decks that have ensured stability for a decade.

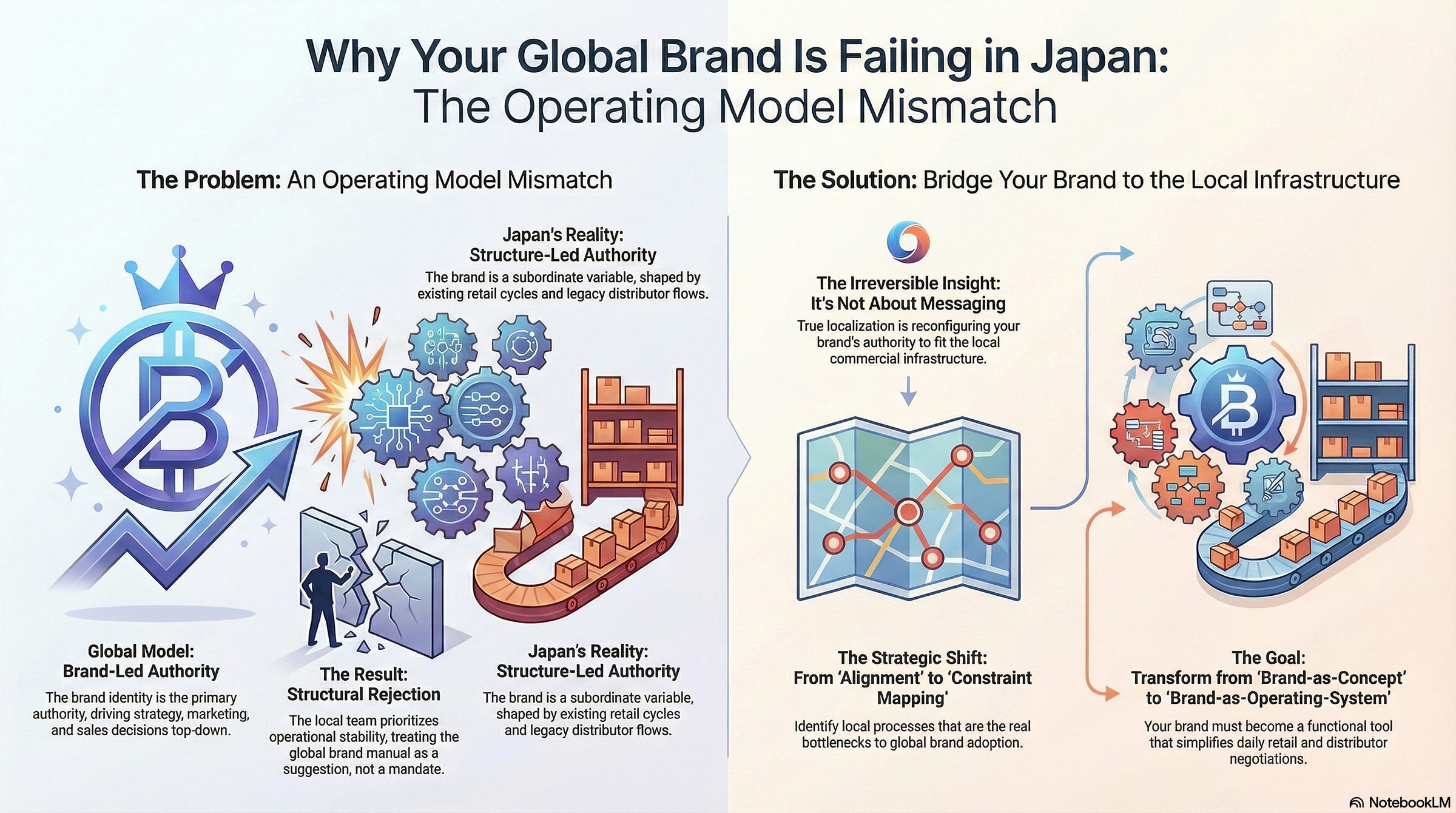

From HQ’s perspective, Japan is “slow to align” or “resistant to the global vision.” In reality, the Japanese office is performing a survival-based rejection of a foreign organ. The global brand logic which assumes that identity drives commercial behavior is colliding with a local operating system where behavior is dictated by retail rhythm and structural precedent. The result is not just a delay in a rebrand; it is a total loss of strategic momentum that costs millions in untapped scale.

The Mechanism: The Operating Model Mismatch

This is not a culture issue. This is an Operating Model Mismatch.

Most multinationals operate on a Brand-Led model: the brand identity is the primary source of authority. Strategy drives marketing, marketing drives sales, and the positioning shapes every commercial decision. This is a top-down, identity-driven architecture where the “Brand” is the sun around which all other functions orbit.

In Japan, however, the dominant system is the Structure-Led model. Here, “Brand” is not the driver; it is a subordinate variable of the operating structure. Progress is shaped by stability, established routines, and activity-based branding. Success is measured by how seamlessly the product fits into existing retail cycles and legacy distributor flows.

Real-World Proof: The Curaprox Collision

Consider the case of Curaprox. In Switzerland, the company functions through a sophisticated Brand-Led system. The identity is the value proposition. When this logic was pushed into the Japanese market, it hit a structural wall.

In the Japanese dental and retail channels, “Brand” is often treated as secondary to:

Precedent: If a specific promotional cadence has historically worked in the drugstore channel, that cadence is the “Fixed Point,” not the new global brand calendar.

Process (The Ringi Flow): The requirement for consensus-based approval prioritizes risk-avoidance over bold positioning. A “bold” global shift is a variable that introduces unquantified risk into the consensus web.

Social Stability: A global identity change that requires a distributor to alter their legacy catalog layout is seen as a breach of the “internal social contract.”

When HQ mandates a shift toward a global brand-led model, they are essentially asking the Japanese team to dismantle the very structural foundations that have provided their stability. Because the global “Positioning” isn’t translated into a “Functional Operating Protocol,” the local team has no choice but to treat the brand manual as a decorative suggestion rather than a commercial mandate.

The Strategic Shift: From Identity to Infrastructure

The irreversible insight required here is that in Japan, you cannot “install” a brand; you must “bridge” it into the existing operating architecture. If your global positioning requires your local team to break their established retail rhythms without a structural “bridge,” they will prioritize the rhythm every time. They are not being “disloyal” to the brand; they are being loyal to the commercial infrastructure that pays the bills.

The Single Irreversible Insight

Localization in Japan is not the adjustment of your message; it is the reconfiguration of your brand’s authority to fit the local commercial infrastructure.

Until you map your global “Identity” onto the local “Activity,” your brand will remain a high-cost friction point. To scale, you must move from Brand-as-Concept to Brand-as-Operating-System.

Explicit Reframing: Not Strategy, but Architecture

The Problem is not “Alignment”: It is the Lack of Shared Definitions. HQ defines “Positioning” as a creative North Star; the Japanese team defines “Positioning” as “where the product sits on a physical shelf in Omeda.”

The Shift is not “Better Communication”: It is Constraint Mapping. You must identify the specific local processes—the legacy documentation, the distributor contracts, the shelf-space protocols—that are the actual bottlenecks to global brand behavior.

When you bridge the system, you stop fighting your own infrastructure. You move from “forcing an identity” to “upgrading the activity.” This requires a transition roadmap that allows the local team to move toward global standards without violating the internal social contract of stability. If the “Brand” doesn’t help the local team manage their retail relationships more predictably, the local team will treat the Brand as a threat to be neutralized.

The Bottom Line

Most global brands fail to scale in Japan because they attempt to force a “Brand-Led” identity onto a “Structure-Led” environment. Without a functional bridge between these two incompatible logics, your global strategy will continue to function as a source of internal friction rather than market authority.

Over to You

Does your Japan team currently treat your brand guidelines as a set of identity rules they must “obey,” or as a functional operating system that actually simplifies their daily retail and distributor negotiations?